I can only imagine how the public feels regarding real estate in the Palos Verdes and South Bay areas with the news media’s seemingly conflicting reporting . Yesterday’s LA Times Business section headline, “March a cruel month – Foreclosures take over…” is only 8 days after the LA Times Business section headline, “Home prices staying afloat at the beach” (see my post “Now You’re Talking” April 8, 2008).

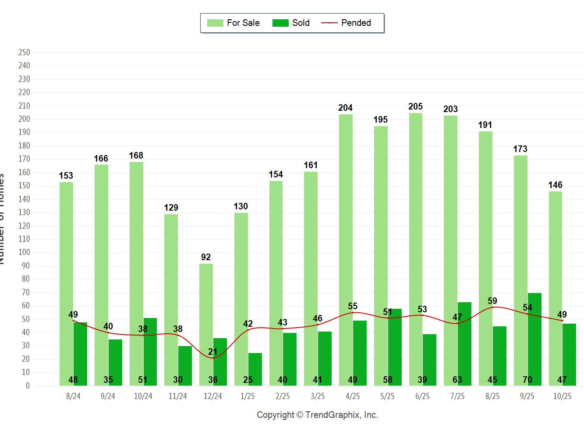

Let’s look at the new 5-page Facts and Trends reports (click here or go to the Statistics tab above)for the Palos Verdes Peninsula with data from January 2007 through March 2008. The number of homes sold 49 (Mar ’07) vs. 33 (Mar ’08), number of homes for sale 157 (Mar ’07) vs. 235 (Mar ’08), number of homes pending 37 (Mar ’07) vs. 33 (Mar ’08). It definitely shows a slowing compared to March 2007, but look at the months in between. March 2008 had more homes sold six out of the last seven months (November 2007 was higher with 35 homes sold).

What does it all mean? Real estate in the Palos Verdes-South Bay area is softer than last year but better than most of Los Angeles County. We are not seeing as many foreclosures as the rest of the County (which is driving the prices downward in those communities). Average sold price on the Palos Verdes Peninsula (as shown on the Average Price For Sale & Sold graph at Statistics tab) for March ’08 was $1,608,000 vs. $1,390,000 for March ’07. Of the 11 months in between, 6 months had average sold prices less than March ’08 and 5 months had average sold prices higher than March ‘o8.

For Sellers – Price your property realistically with no padding; look at the sales prices of the most recently closed escrows not prices of homes currently on the market. Robin and Eric Fenchel in their post “Ask Less and Get More: A House Priced Well Will Sell!” reiterate the dangers of overpricing.

For Buyers– This is your time. There is a lot of inventory and interest rates are at historic lows. Lending rules have changed so it is imperative that you speak to a lender for a prequalification and lock in a 30-day rate (many lenders believe that rates will be going up before the end of the year). An increase of 1% in interest rates decreases affordability by 10%.

Join The Discussion